Budgeting, investing, and saving are two of the most important things you can do to help yourself achieve financial success. They are important regardless of income, as there are people who make more than hundreds of thousands of dollars a year and are still broke. Here are simple approaches that work for lots of people, and can help ensure wealth in the future.

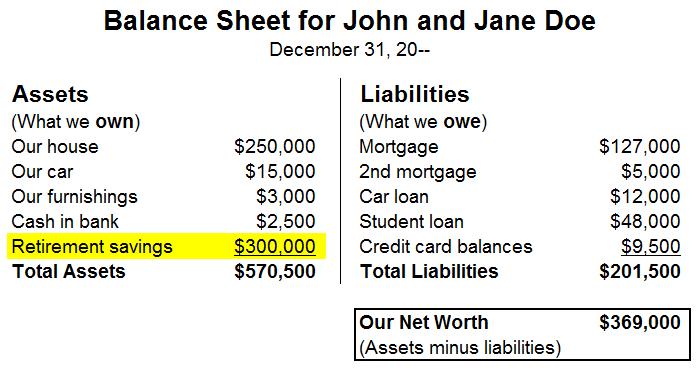

One of the strategies you can use to better budget is by creating a personal balance sheet. By creating a balance sheet on the first of the month and logging your assets and liabilities, you can see what your sources of income are, how much that income totals to for the month, how much your liabilities add up to, and how much money you are left with at the end of the month. Since all of your expenses and assets will be laid out for you using this type of template, you can see which expenses are unnecessary or impulse decisions, and it will make it easier for you to cut back on your spending and see the impact that it has.

Forced Saving

Another way to put money aside is through forced saving/ auto withdrawing money from your bank account each time you collect a paycheck. Let’s say you’re making $5,000 a month and want to save 40% of it. Automatically withdraw $2,000, put it into a savings account, investment account, or some type of emergency fund, and then live off of the other $3,000. This will trick your brain into thinking that you have less money than you actually do, and will make it easier and more convenient to save money.

Creating an Emergency Fund

CNBC conducted a study that concluded only 39% of Americans would be able to pay for a $1,000 emergency without going into debt. This is alarming news and highlights the importance of creating an emergency fund. For an example of how to create an emergency fund, we can look at our previous example. Out of the $2,000 that we are saving, we can contribute a portion of that money to our emergency fund, say 40% of that or $800. We keep contributing money to our emergency fund until we have reached around 6 months’ worth of living expenses covered (rent, gas, food, etc…), and then we can periodically keep contributing to our fund. Life is always throwing curveballs at us, and especially these past 2 years with the pandemic, having this type of emergency fund created would have helped lots of families out through hard financial times.

Investment/Retirement Accounts

Opening up investment and retirement accounts are two of the best things you can do to become wealthier in the future. An example of a retirement account would be a Roth IRA in which you contribute after-tax money into the account and then invest the money, typically into an index fund. The maximum contribution is $6,000 per year, and you can withdraw the money at the age of 59 ½. The best part about this account is that since you already paid taxes on your contributions, the money that you withdraw is completely tax-free. Compound interest works wonders with this account, and if you start out at 18, investing the max amount of money per year ($6,000), you will end up with around $2.1 million dollars tax-free at 59 ½ with an annual return of 7% on your investment, the return rate typically seen in index funds. Another thing you can do to try and grow your wealth is investing in stock, crypto, and index funds separately, using an account on Charles Schwab, E-trade, etc… This will also help you make passive income, especially as you increase the amount of money in your portfolio.